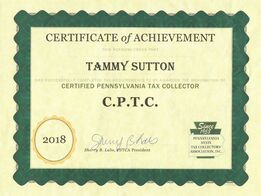

Welcome to the Newtown Township Tax Office. Tammy L Sutton, Elected Municipal Tax Collector C.P.T.C.

This office collects Real Estate and Residents Occupation Taxes for the County of Bucks, Township of Newtown and

Council Rock School District.

We are located in the Newtown Township Municipal Center on Route 413 in Newtown Twp, Bucks County, PA

This office collects Real Estate and Residents Occupation Taxes for the County of Bucks, Township of Newtown and

Council Rock School District.

We are located in the Newtown Township Municipal Center on Route 413 in Newtown Twp, Bucks County, PA

NEWTOWN TOWNSHIP TAX OFFICE

TAMMY L SUTTON, TAX COLLECTOR, C.P.T.C.

BUCKS COUNTY

PENNSYLVANIA

|

IMPORTANT NOTES

2024 School Real Estate Tax bills were issued July 1, 2024 2024 Occupation Tax Bills were issued July 1, 2024 |

MAILING ADDRESS 100 Municipal Drive Suite 101 Newtown, PA 18940 Phone: 215-968-2800 ext 244 FAX: 215-968-5368 email: [email protected] NORMAL BUSINESS HOURS: MONDAY - THURSDAY 9:30 - 4:00 FRIDAYS & HOLIDAYS: CLOSED OFF SEASON HOURS EFFECTIVE DECEMBER 1 - MARCH 1 MONDAY - THURSDAY 9:30AM - 1:00PM Fridays Closed IF YOU REQUIRE ASSISTANCE OUTSIDE THESE HOURS, PLEASE CONTACT US VIA EMAIL OR VOICEMAIL AND WE WILL RESPOND |

IF YOU HAVE NOT YET PAID YOUR 2023 REAL ESTATE TAXCOUNTY, TOWNSHIP REAL ESTATE TAX BILLS HAVE BEEN SENT TO THE BUCKS COUNTY TAX CLAIM BUREAU FOR LIEN. SCHOOL REAL ESTATE TAX BILLS HAVE BEEN SENT TO THEIR NEW DELINQUENT COLLECTOR, PORTNOFF LAW ASSOC. FOR LIEN. IF YOU HAVE AN UNPAID 2023 REAL ESTATE TAX BILL, PLEASE CONTACT THE APPROPRIATE DELINQUENT COLLECTOR FOR PAYMENT INSTRUCTIONS AND LIEN RAMIFICATIONS. BUCKS COUNTY TAX CLAIM BUREAU 215-348-6274 PORTNOFF LAW ASSOC 866-211-9466 |

|

SCHOOL R/E TAX DUE DATESThe Last day to pay School Real Estate Tax with the 2% discount is always August 31st. The last day to pay without penalty is always October 31st.

If you did not receive your tax bill, please contact our office for a copy. The Tax Collector cannot waive penalties or extend due dates due to not having received your bill!! |

YOU MAY ALWAYS DROP YOUR PAYMENTS IN THE DROP BOX LOCATED OUTSTIDE THE BUILDING, A RECEIPT WILL BE MAILED TO YOU

Please click on "Real Estate Taxes" at the top of the page for information regarding the Homestead Exclusion Credit for School Real Estate Taxes.